| StockFetcher Forums · Stock Picks and Trading · Shills Swing N Daily | << 1 ... 274 275 276 277 278 ... 493 >>Post Follow-up |

| pthomas215 1,251 posts msg #134169 - Ignore pthomas215 |

2/9/2017 1:47:41 PM agree...that is why I asked. Kevin's system wasnt really a system because it did not take into consideration those two elements. If I find a good system I will let you know. I am still intrigued around trading the VIX daily and weekly. |

| shillllihs 6,088 posts msg #134171 - Ignore shillllihs |

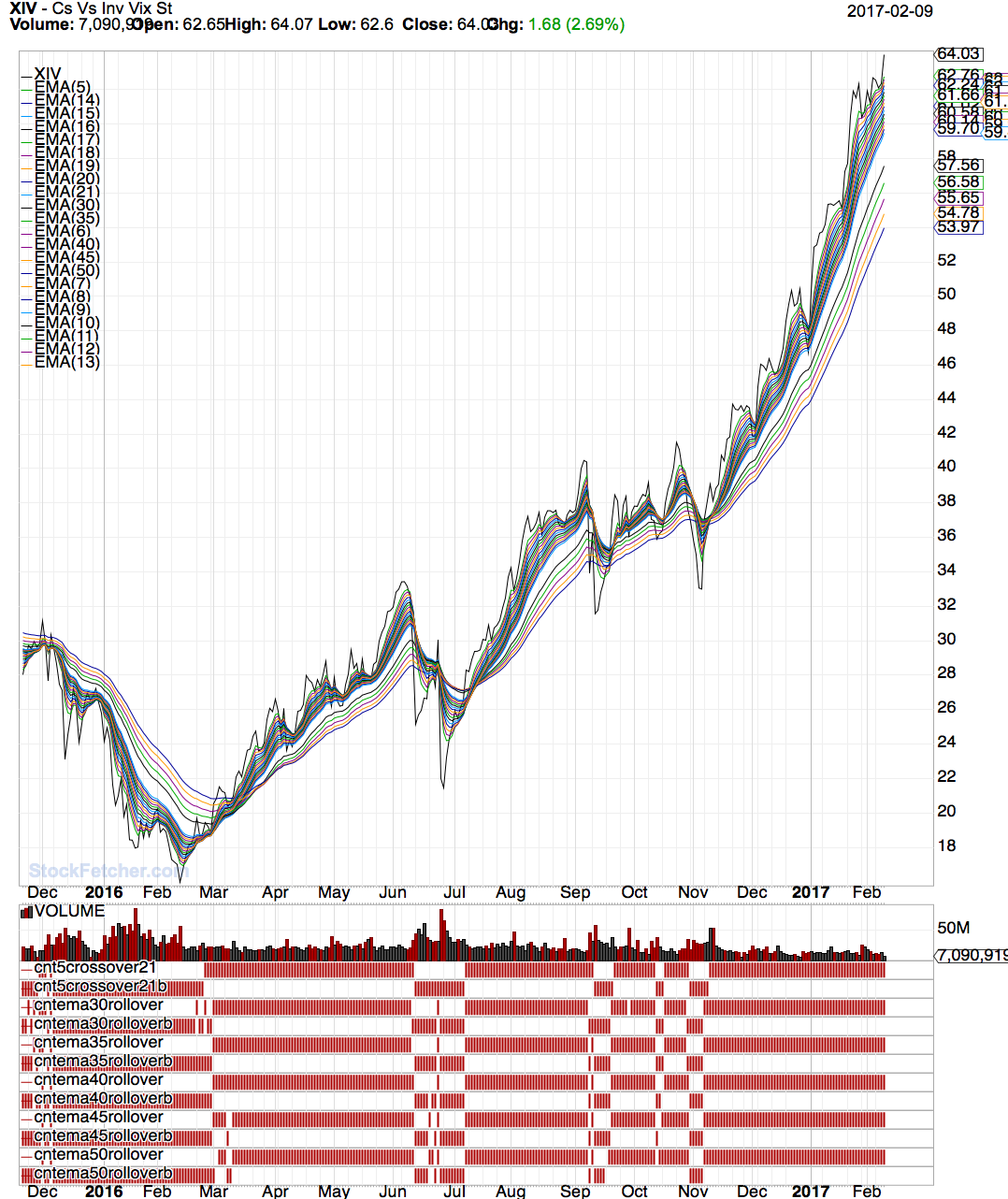

2/9/2017 2:26:24 PM Pt, look at every time Xiv was at top bollinger with top Acc. BAND, it bounced back down to the mid line. There is a touch in late Dec. that hasn't reverted yet. Not saying it will but that's enough to keep me off of Xiv. it could go to 46... But nothing is certain. If you have the ballz, you can either SHORT Xiv or go long Tvix Vxx. |

| Mactheriverrat 3,172 posts msg #134175 - Ignore Mactheriverrat |

2/9/2017 2:59:20 PM That XIV is a very giving chart indeed!!!  |

| pthomas215 1,251 posts msg #134177 - Ignore pthomas215 |

2/9/2017 3:24:19 PM shillihs, very nice. thank you. i am going to short XIV towards the last week of February. Shorting gold when GLD gets to 120 |

| Kevin_in_GA 4,599 posts msg #134179 - Ignore Kevin_in_GA |

2/9/2017 3:42:51 PM Trade XIV as you see fit. I'll continue to use contango levels as my signals. |

| shillllihs 6,088 posts msg #134191 - Ignore shillllihs |

2/10/2017 9:26:17 AM Shorted a tiny little bit of Xiv at 64.20. 33 Sh. Will just keep it on till it tanks. |

| shillllihs 6,088 posts msg #134193 - Ignore shillllihs |

2/10/2017 9:35:17 AM I'm not greedy. Direxion Daily Jr Gld Mnrs Bear 3X ETF (JDST) 14.21+0.62 (+4.56%) As of 9:31AM EST. |

| T_Charp13 35 posts msg #134197 - Ignore T_Charp13 |

2/10/2017 10:46:44 AM Wouldn't it be safer to go long JNUG instead of shorting JDST? |

| shillllihs 6,088 posts msg #134198 - Ignore shillllihs |

2/10/2017 11:12:27 AM I was long Jdst and made off great. |

| Kevin_in_GA 4,599 posts msg #134199 - Ignore Kevin_in_GA |

2/10/2017 11:22:08 AM My mirror image of your trade (short NUGT) worked out nicely as well. Now is the time to look at possible short on DUST. As to the question regarding risk of shorting versus going long the inverse, one should remember that triply-leveraged ETFS like DUST/NUGT or JNUG/JDST suffer from daily resets that drag down performance on both ETFs. Thus, shorting is preferred since you are swimming with the current rather than against it. |

| StockFetcher Forums · Stock Picks and Trading · Shills Swing N Daily | << 1 ... 274 275 276 277 278 ... 493 >>Post Follow-up |